Social

1,287

Shippensburg University Foundation

Helping Shippensburg University students and the region exceed expectations.

2 months ago

Every graduate’s journey is powered by people who believe in them. When you make your gift by June 30 to the Shippensburg University Foundation, you become part of that journey—turning ambition into achievement and dreams into degrees. Thank you for being part of their Ship story. tinyurl.com/SUFgive

... See MoreSee Less

Shippensburg University Foundation

updated their cover photo.

2 months ago

Shippensburg University Foundation's cover photo

... See MoreSee Less

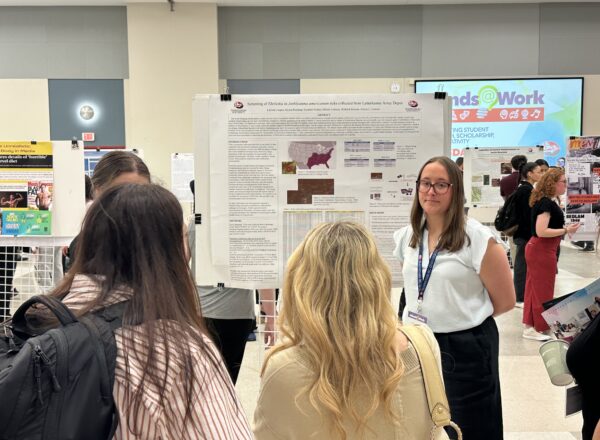

2 months ago

Real Investing. Real Returns. Real Impact. ![]()

![]() Shippensburg University’s Investment Management Program gives students hands-on experience managing a $500,000 portfolio. This year, the student team achieved an impressive 36% return, outperforming the S&P 500 by 16%! 💼🔥

Shippensburg University’s Investment Management Program gives students hands-on experience managing a $500,000 portfolio. This year, the student team achieved an impressive 36% return, outperforming the S&P 500 by 16%! 💼🔥![]()

![]() Ship students are gaining the skills, confidence, and experience to lead in the finance world. Support the future of finance—ma

... See MoreSee Less

Ship students are gaining the skills, confidence, and experience to lead in the finance world. Support the future of finance—ma

... See MoreSee Less

tinyurl.com

3 months ago

Shippensburg University Foundation

updated their cover photo.

3 months ago

Shippensburg University Foundation's cover photo

... See MoreSee Less

Recent News

Transformational Gift Impacts Current and Future Engineering Students

September 27, 2022

Transformational Gift Impacts Current and Future Engineering Students

September 27, 2022